Disability Scenario Flow with Script: A Deeper Dive into an Underserved Space

Disability income protection is one of the most overlooked yet lucrative areas for consultants to explore. With limited market offerings, increasing public awareness driven by government initiatives like CareShield Life, and minimal overlap with traditional coverage types, this space presents both a gap and an opportunity.

This guide breaks down the current definitions used in the market, provides strategic positioning angles, and ends with a practical script to bring this conversation to life with clients.

Understanding the Two Key Definitions

1. Total and Permanent Disability (TPD) – Commonly Found in Life Insurance

Usually valid until age 65/70 or through the entire policy term (depending on the policy), the definition includes:

Inability to engage in any occupation or activity that provides income, or

Permanent loss of:

Both eyes

Any two limbs (above the wrist or ankle)

One eye and one limb (above the wrist or ankle)

OR the inability to perform at least three out of six Activities of Daily Living (ADLs) for a minimum of six consecutive months.

2. Loss of Independent Existence – Found in Critical Illness Policies

This definition is typically used in whole life or term CI coverage and is defined as:

"A condition arising from illness, injury, or disease that results in the inability (with or without aid) to perform at least three of the six ADLs continuously for six months, certified by an approved medical professional."

Disparity Between Claims Experience & Statistics

From the above, a key gap in the market becomes apparent—most disability coverage only lasts up to a specific age, such as 65 or 70.

While some coverage may continue past that age, the conditions required to trigger a payout remain difficult to fulfill.

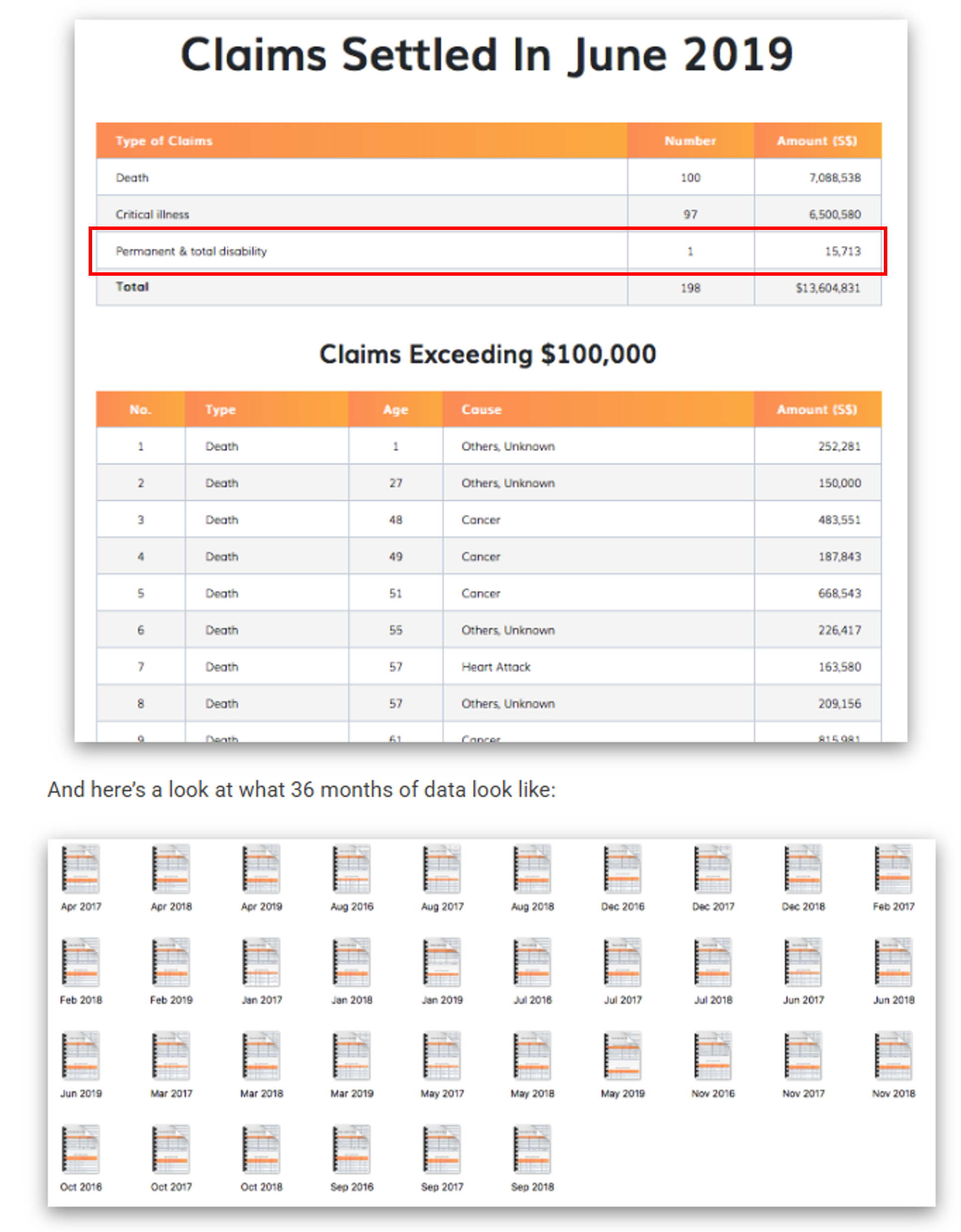

This is reflected in the data: TPD claims make up only 2.81% of all life insurance payouts, despite statistics showing that 1 in 2 healthy Singaporeans aged 65 will experience a severe disability and may require long-term care.

This disconnect between the likelihood of disability and the actual payout rates suggests several possible causes:

Disabilities occur but fail to meet strict payout criteria

Disabilities happen after policy limitations, such as term plans that expire at 70 or older whole life plans where disability benefits cease at age 65 or 70

These insights underscore the need for more thoughtful and tailored disability income planning.

This brings us to the solution that addresses the gap—disability income policies. These plans typically offer more accessible qualifying criteria, such as the inability to continue in one’s current occupation due to illness or injury during working years, or the inability to perform just 1 or 2 ADLs for CareShield Life Supplements as opposed to 3.

In this article, we’ll focus on how to use Edge Planner to build a strong narrative that supports a higher-tier CareShield Life supplement recommendation. You’ll also find a sample roleplay script that you can adapt to your own style—helping you confidently add disability income solutions to your advisory toolkit.

In-Appointment Scenario Script with Edge

Consultant (Assuming CareShield Life has been introduced):

"Now that we’ve gone through the benefits of CareShield Life Supplements, let’s look at some key considerations to help you decide on a suitable monthly payout amount."(At this point, open Edge Planner and input the client’s current insurance details. Create a scenario—e.g., $2,000 monthly payout with 3% inflation from age 71 to 80—to simulate long-term care funding needs.)

Step 2: Introduce the Insurance Gap

You can position this with two alternative narratives, depending on the client’s current coverage:

Option A – Limited Policy Duration (Example Above):

Consultant: "One important shortfall to note is that your life insurance’s disability coverage ends at age 70. So if something were to happen after that, there wouldn’t be a lump sum payout to rely on."Option B – Coverage Applies, But Comes with High Barriers for Payout:

Consultant: "While your life insurance does include disability protection, the payout criteria are quite strict. For example, permanent loss of both eyes, any two limbs, or one eye and one limb. That’s a high threshold."

Step 3: Relate to Real-Life Scenarios

Consultant: "And to note, disability can come in many other forms—such as stroke or dementia—which may severely affect one’s daily functioning but still fall short of meeting these policy definitions.

That’s where long-term care planning through CareShield Life supplements becomes important as it’s based on reduced ADLs of just 1 or 2 categories to hit."

Consultant: "Let’s imagine a scenario where something happens between age 71 to 80—these are key years when care needs tend to rise. The current min amount for caregiver support along with increased transportation cost needs is about $2k/m,

With inflation factored in, that amount grows significantly. Over 10 years, that could total around $[annual expense - $60,000 from example] per year, and in all, about $[total impact - $687k from example] drawn directly from your retirement savings—since these costs aren’t covered by your hospital plan."

Consultant: "To help manage that risk, we can consider boosting your CareShield Life supplement which provides lifetime monthly payout upon disability.

The good news is that it can be partly funded using Medisave, and premiums are still reasonable at your current age. Even covering just 50% of this projected need—say, a $[proposed payout - $3k]/month benefit—could provide very meaningful protection together with future CPF payout."

"For a cash outlay of about $[estimated premium], you’d be securing lifelong peace of mind against something that statistically affects 1 in 2 people after age 65."

This approach helps you transition beyond the default, cashless CareShield Life Supplement option. While easier to present, it limits your ability to fully address the significant coverage gap—missing an opportunity that can benefit both you and your client.