Optimizing ILP Illustrations with Smart Save & Load Practices

With the introduction of this simple Save & Load feature, consultants can now pre-save their preferred ILP settings—unlocking new ways to drive sales efficiency during appointments.

This means you can preset frequently used ILP structures that vary in premium term, welcome bonus, loyalty bonus, and policy charges—elements that typically require repeated manual input.

Once saved, you’ll only need to tweak the age, performance and dividend rates to match the specific narrative or client scenario. This not only saves time but also allows for smoother, more confident presentations that can better support your sales goals.

Example of Ideas

ILP (5 Pay), ILP (10 Pay) and ILP (15 Pay) etc

💡 Elevate Your ILP Pitch with Pre-Saved Concept Structures

Beyond the standard ILP configurations, consultants can now pre-save concept-selling scenarios to instantly present tailored narratives during appointments. This forward-thinking approach enhances engagement and makes complex ILP benefits easier to communicate.

We’ve outlined 5 ready-to-use ILP concept setups based on life stage, each designed to address different planning needs:

———

👩💼 For Clients in Their 20s to 40s:

A) Long-Term ILP – Dividend Breakeven Model

Demonstrate how dividends can help offset premiums in the early years—eventually reaching breakeven and turning all future payouts into pure bonuses.This creates a highly liquid investment approach, where the account value compared to net premiums reflects an attractive return.

To understand this concept more thoroughly, take a look at this article. - 5x Investment Return Strategy - Dividend — A-Think Lab

⚙️ Possible Pre-Set Settings

1) Withdraw Dividend - ✅

2) Withdraw Dividend Start Year - 1 (Straight from the start)

3) Premium Term - 25 Years

4) Premium (Annually) - Subject to Consultant’s Strategy

5) Welcome Bonus - Based on Policy Configuration

6) Loyalty Bonus - Based on Policy Configuration

7) Dividend Rate - 5%

8) Fund Performance - 3%

9) Policy Charge - Based on Policy Configuration

————

B) Long-Term ILP – Equity-Focused Transitioning to Dividends & Withdrawal at Retirement (Still Retaining Legacy)

Demonstrate a growth-first approach that shifts toward income generation during retirement.

⚙️ Possible Pre-Set Settings

1) Withdraw Dividend - ✅

2) Withdraw Dividend Start Year - 1 (Straight from the start)

3) Withdrawal - On, Withdraw $20,000 from 60 to 85

4) Premium Term - 25 Years

5) Premium (Annually) - Subject to Consultant’s Strategy

6) Welcome Bonus - Based on Policy Configuration

7) Loyalty Bonus - Based on Policy Configuration

8) Dividend Rate - 0%

Custom Dividend Rate - 4% at 65 Years Old

8) Fund Performance - 8%

Custom Performance - 3% at 65 Years Old

9) Policy Charge - Based on Policy Configuration

————

👨🦳 For Clients in Their 50s and Above:

C) Single Premium to Regular Premium Strategy

Illustrate the benefits of convincing lump sum capital into a regular premium structure for legacy planning with attractive flexibility.

To understand this concept more thoroughly, take a look at this article. - Turning Single Premium Preferences into Big Regular Premium Wins (ILP) — A-Think Lab

Referencing from example in above article,

⚙️ Possible Pre-Set Settings

1) Withdraw Dividend - ✅

2) Withdraw Dividend Start Year - 1 (Straight from the start)

3) Withdrawal - On, Withdraw $20,000 from 50 to 59 and $10,000 from 60 to 85

4) Premium Term - 10 Years

5) Initial Investment - $330,000

6) Premium (Annually) - Subject to Consultant’s Strategy, example $16,800

7) Welcome Bonus - Based on Policy Configuration

8) Loyalty Bonus - Based on Policy Configuration

9) Dividend Rate - 5%

10) Fund Performance - 3%

11) Policy Charge - Based on Policy Configuration

————

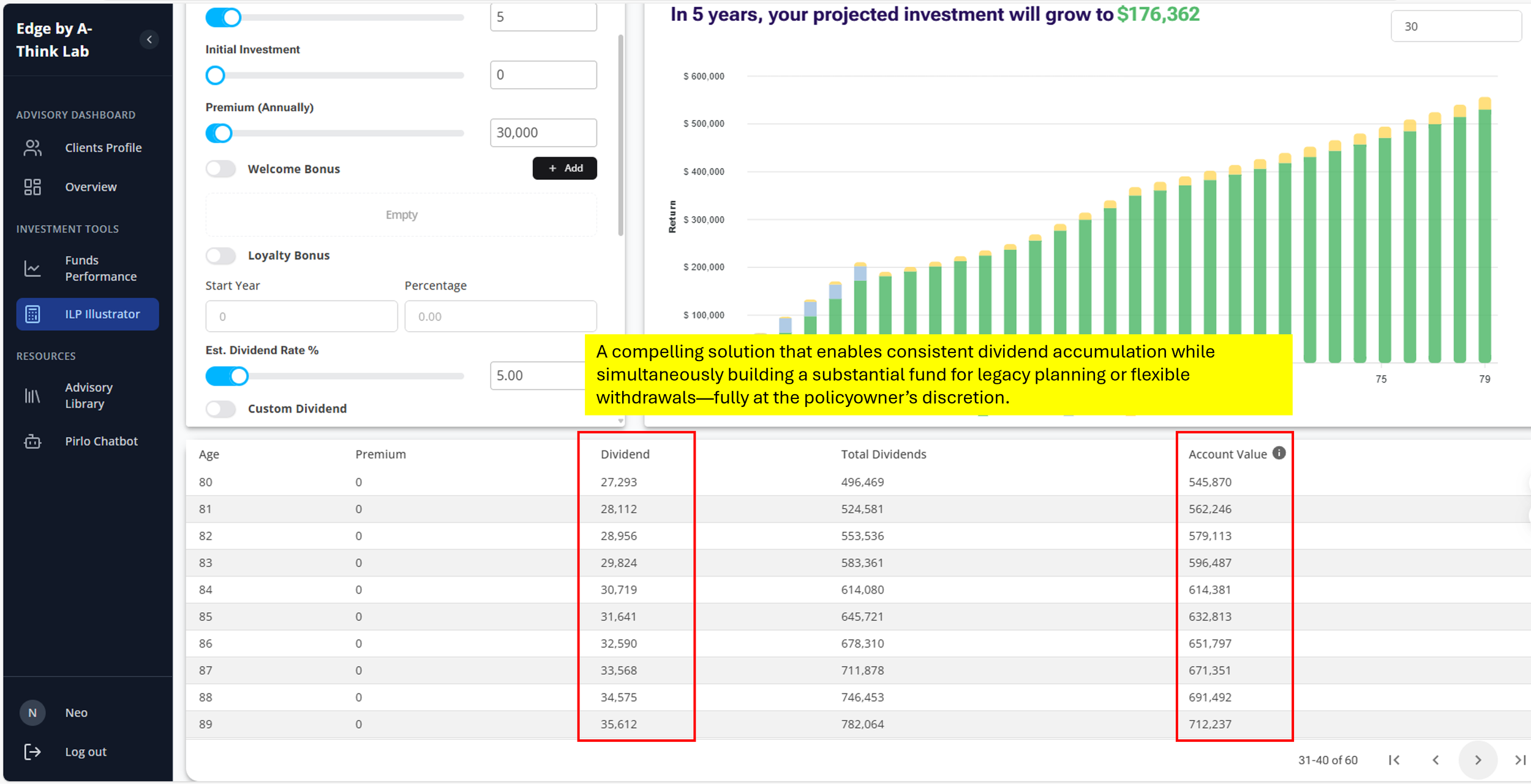

D) Short-Term ILP – Dividend Focused with Legacy Planning

Focuses on wealth preservation and passing on value efficiently.

⚙️ Possible Pre-Set Settings

1) Withdraw Dividend - ✅

2) Withdraw Dividend Start Year - 1 (Straight from the start)

3) Premium Term - 5 Years

4) Premium (Annually) - Subject to Consultant’s Strategy, example $30,000

5) Welcome Bonus - Based on Policy Configuration

6) Loyalty Bonus - Based on Policy Configuration

7) Dividend Rate - 5%

8) Fund Performance - 3%

9) Policy Charge - Based on Policy Configuration

————

E) Short-Term ILP – Dividend Focused with Drawdown Strategy

Focused on dividends with the flexibility to support partial withdrawals through a drawdown strategy during retirement.

⚙️ Possible Pre-Set Settings

1) Withdraw Dividend - ✅

2) Withdraw Dividend Start Year - 16 (Straight from the start)

3) Withdrawal - Start at 65 till 85, $20,000 Annually

4) Premium Term - 5 Years

5) Premium (Annually) - Subject to Consultant’s Strategy, example $30,000

6) Welcome Bonus - Based on Policy Configuration

7) Loyalty Bonus - Based on Policy Configuration

8) Dividend Rate - 5%

9) Fund Performance - 3%

10) Policy Charge - Based on Policy Configuration